Workers’ compensation fraud has a profound cost and impact on all parties involved. However, identifying and addressing fraud requires a thorough understanding of what it looks like, who commits it, how to detect and prove it, and more.

At Bosco Legal, we have over 30 years of experience as an industry leader supporting litigation through services including workers’ compensation fraud investigations. In this article, we share some of that knowledge for a comprehensive guide that demystifies:

- What Is Workers’ Compensation Fraud?

- What Is the Impact of Workers’ Compensation Fraud?

- How Is Workers’ Comp Fraud Detected?

- How Do You Prove a Claim is Fraudulent?

- How Do You Prevent Workers’ Comp Fraud?

What is Workers’ Compensation Fraud?

Workers’ compensation fraud and abuse are crimes committed when an individual or business entity misrepresents facts to obtain facts, evade responsibility, or influence costs like premiums. Different parties in the claims process can commit fraud, including employees, business owners, healthcare providers, and insurance companies.

How Often Does It Occur?

Studies show that one to two percent of all workers’ compensation claims are fraudulent. However, this still bears a significant financial burden on stakeholders, as we’ll discuss later in this article.

Who Commits Workers’ Compensation Fraud?

Virtually every group of individuals involved in a workers’ compensation claim can commit some form of workers’ compensation fraud. This includes:

- Claimants

- Employers

- Insurance companies

- Healthcare providers

- Attorneys

What Are the Most Common Types of Workers’ Compensation Fraud?

Employees most commonly commit fraud by faking or exaggerating injuries, claiming injuries are work-related when they didn’t happen at work, or continuing to collect disability benefits after fully healing. Meanwhile, employers commit fraud by underreporting payroll, misclassifying workers, or denying valid claims when employees are injured.

Medical providers can commit workers’ compensation fraud and abuse too. Below are common types of fraud committed by different stakeholders in the process:

Claimant Fraud

- Knowingly make a false injury claim

- Faking an injury or exaggerating its severity

- Claiming an injury that didn’t happen at work

- Making multiple claims associated with multiple identities

- Underreporting income

Employer Fraud

- Knowingly altering the truth to avoid, deny, or obtain compensation on behalf of an employee

- Underreporting wages or misclassifying employees to get lower insurance premiums

- Attempting to discourage an injured employee from pursuing claims

Healthcare Provider Fraud

- Inflating bills

- Billing for services not rendered

Attorney Fraud

- Knowingly assisting a client in filing a false claim

- Routing claims to a clinic for kickback

What Is the Impact of Workers’ Compensation Fraud?

Fraud undermines the integrity of the insurance and workers’ compensation system, burdens the economy, deprives injured workers of their benefits, and shifts costs onto businesses and consumers.

What Is the Cost of Workers’ Comp Fraud?

The National Insurance Crime Bureau (NICB) estimates that workers’ compensation fraud is a $30 billion problem nationwide each year. In California alone, it costs the state between $1 billion to $3 billion annually.

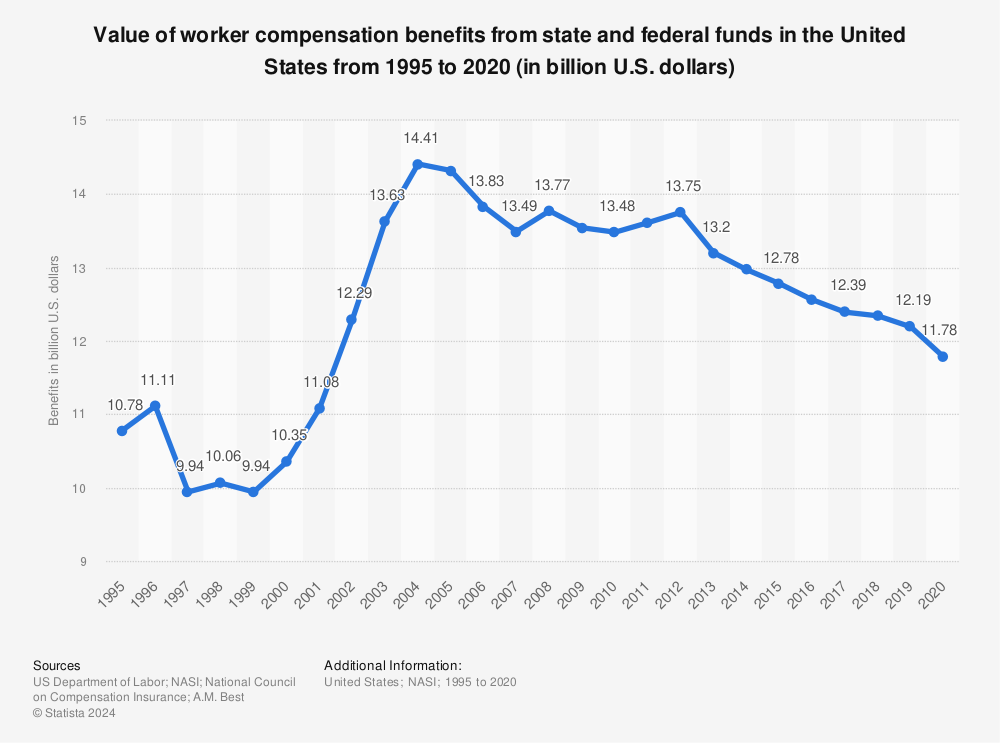

Find more statistics at Statista

What Is the Penalty For Workers’ Comp Fraud in California?

Workers’ compensation laws are determined by each state concerning fraud. According to the California Department of Industrial Relations, the workers’ compensation fraud penalties in California can vary. It’s what’s often referred to in legal terms as a “wobbler” — i.e. it can be charged as either a felony or a misdemeanor and the penalty will vary based on the classification.

As a misdemeanor, the crime could result in up to a year in jail along with a fine of up to $150,000 or double the amount of fraud, depending on which number is greater.

When charged as a felony, there is the possibility of two to five years of jail time, coupled with a fine of up to $150,000 or double the amount of fraud, depending on which number is greater.

How Is Workers’ Comp Fraud Detected?

Detecting workers’ compensation is possible through different strategies, sometimes in combination. These may include:

- Investigations – A third-party investigator can conduct research and surveillance to understand whether there is possible fraud, as well as the evidence there is to prove it.

- Claims Analysis – Data analysis can help detect patterns and anomalies in claims data that point to possible fraud, including identifying multiple claims by a single party or identifying the day of the week that most fraudulent claims are made.

- Reporting Hotlines – Insurance companies and government agencies will usually have their phone hotlines or an online portal where parties can report suspected fraud.

What Are the Most Common Warning Signs of Workers’ Compensation Fraud?

In our experience, a claim may be fraudulent if two or more of the following red flags are present:

- Monday Morning – The alleged injury occurs either first thing Monday morning or late on a Friday afternoon, but it is not reported until Monday.

- Employment Change – The reported accident occurs immediately before or after a strike, a layoff, the end of a big project, or after seasonal work.

- Job Termination – If an employee files a post-termination claim, was the alleged injury reported by the employee before termination? Or, did they exhaust their unemployment benefits prior to claiming workers’ compensation benefits?

- History of Changes – The claimant has a history of frequently changing physicians, addresses, and places of employment.

- Medical History – The employee has a pre-existing medical condition that is similar to the alleged job injury.

- No Witnesses – The accident has no witnesses, and the employee’s description does not logically support the cause of injury.

- Conflicting Descriptions – The employee’s description of the accident conflicts with the medical history or First Report of Injury.

- History of Claims – The claimant has a history of numerous suspicious or litigated claims.

- Medical Treatment Refused – The claimant refuses a diagnostic procedure to confirm the nature or extent of an injury.

- Late Claim – The employee delays reporting the claim without a reasonable explanation.

- Hard to Reach – You have difficulty contacting a claimant at home when they are allegedly limited from activities.

- Moonlighting – Does the employee have another paying job or do volunteer work?

- Unusual Coincidence – There is an unusual coincidence between the employee’s alleged date of injury and their need for personal time off.

- Financial Problems – The employee has tried to borrow money from coworkers or the company, or requested pay advances.

- Related Hobby – The employee has a hobby that could cause an injury similar to the alleged work injury.

How Do You Report Workers’ Compensation Fraud in California?

Report workers’ compensation fraud in California by calling the Department of Insurance’s fraud hotline at (800) 927-4357. You can also locate the number for the Fraud Division office closest to you by visiting their website.

How Do You Prove a Claim is Fraudulent?

To build a prosecutable case, it’s crucial to prove that:

- the statements or representations made are false,

- claim decisions were made based on false statements or representations material to the claim, and

- the statements or representations were made with the intent to defraud.

If there are suspicions of workers’ compensation insurance fraud, a third-party partner like Bosco Legal can help unearth crucial evidence through two powerful tools: investigations and medical records release services. Additionally, these tools can aid in the discovery of relevant information to further confirm suspicions before taking the case to trial.

Investigations

Workers’ compensation investigations and what they look for might vary based on the needs of the case. Different types of investigations will supply different types of relevant data, information, or recordings.

For example, a surveillance investigation or social media investigation could yield images of a claimant taking part in activities that put the severity of their injuries into doubt. Whereas a medical background investigation could show pre-existing medical treatments that were not disclosed in litigation.

Medical Records Release

Based on any of the above, it could prompt the need for medical records retrieval services. Record retrieval for workers’ compensation fraud and abuse cases is most often required as part of a medical canvassing. A third-party service like Bosco Legal will navigate the medical records retrieval process to obtain the relevant information to support litigatory claims.

Who Has the Burden of Proof in California?

In California, the burden of proof falls on an injured employee in a workers’ compensation case. This means that the employee must show enough evidence to support that the injury is work-related. However, work does not need to be the primary cause of the injury for it to be a work-related injury in a valid claim. It may be the case that working made the injury worse or contributed in a meaningful way.

How Do You Prevent Workers’ Comp Fraud?

Even if the verdict in a workers’ compensation fraud case goes in an employer’s favor, they still have to spend time and resources to get that verdict. The best way to truly reduce the cost and impact of fraudulent activity is to prevent it from happening in the first place. The following tactics can help reduce the number of fraudulent claims:

- Training & Education – Educate employees about the workers’ compensation benefits available, the potential consequences of fraudulent claims, and how to safely and anonymously report fraud.

- Regular Audits – Audit your payroll regularly to make sure that all employees are correctly classified and their wages are accurately reported. Misclassification is considered premium manipulation and poses the potential for inadvertent employer fraud caused by outdated documentation.

- Safety Culture – Prevent crimes of opportunity that might have never happened by keeping injuries that could be exaggerated from happening in the first place. A safety-focused work culture, regular safety training, and adherence to regulatory bodies including the Occupational Safety and Health Administration (OSHA) can play a crucial role in this.

- Great Workplaces – When people feel appreciated, compensated, and want to be at work, they’re less likely to commit workers’ compensation fraud.

Nobody Wins When It Comes to Workers’ Comp Fraud

That’s why Bosco Legal is committed to supporting the pursuit of truth in workers’ compensation fraud and abuse cases — primarily by providing industry-leading investigations and record retrieval services.

If you have suspicions of fraud or need third-party support building evidence to support your case, give us a phone call today at (877) 353-8281 to schedule an appointment. You can also send us a message online.